Hello,

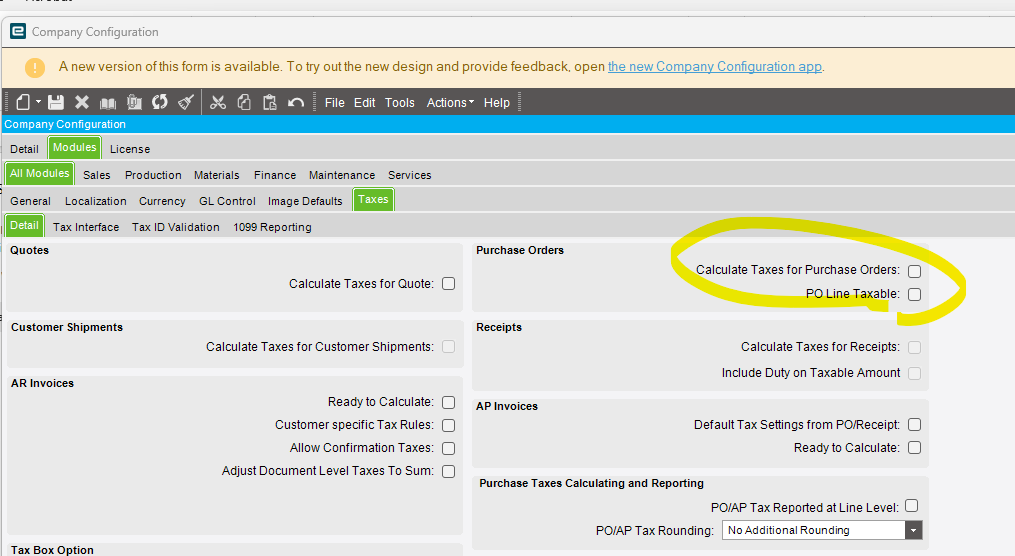

we are a mid sized manufacturing company located in Michigan and I am wondering how you handle sales and use tax on purchases that are taxable? I know there is a check box when creating a PO to mark it taxable but that doesn’t really seem to cause anything to happen in the system. Just wondering if there is a way in Epicor to have the system either calculate or truly notify if a purchase needs to be considered taxable. Thank you!